|

|

|

|

|

Farmer's Coop Association

Products

Cash Bids

Market Data

Grain Commentary

News

Weather

|

Jack Henry & Associates Stock Outlook: Is Wall Street Bullish or Bearish?/Jack%20Henry%20%26%20Associates%2C%20Inc_%20website%20and%20logo%20on%20phone-by%20T_Schneider%20via%20Shutterstock.jpg)

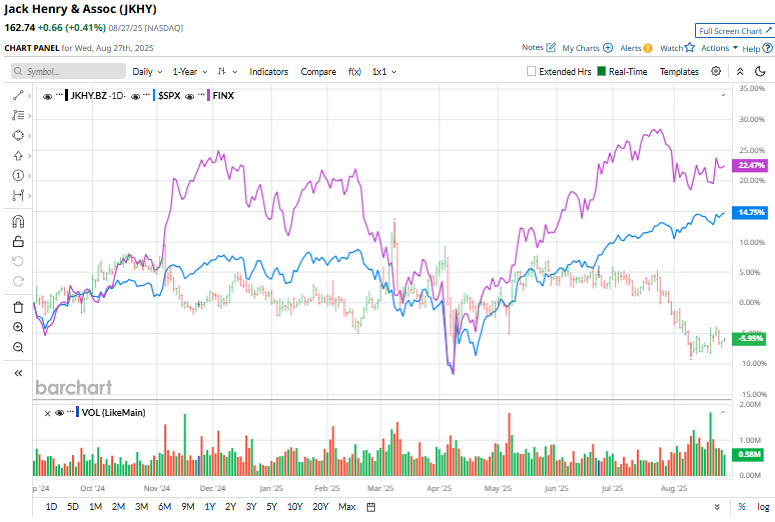

Jack Henry & Associates, Inc. (JKHY) is a Missouri-based financial technology company founded in 1976. With a market cap of $11.8 billion, it provides core processing systems, digital banking solutions, and payment services primarily for community banks and credit unions through its Jack Henry Banking, Symitar, and ProfitStars brands. Shares of this fintech titan have underperformed the broader market over the past year. JKHY has declined 5.1% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 15.2%. Moreover, in 2025, JKHY’s stock fell 7.2%, trailing the SPX’s 10.2% rise on a YTD basis. Narrowing the focus, JKHY has also lagged behind the Global X FinTech ETF (FINX). The exchange-traded fund has gained about 23.9% over the past year and a 7.7% rise in 2025.

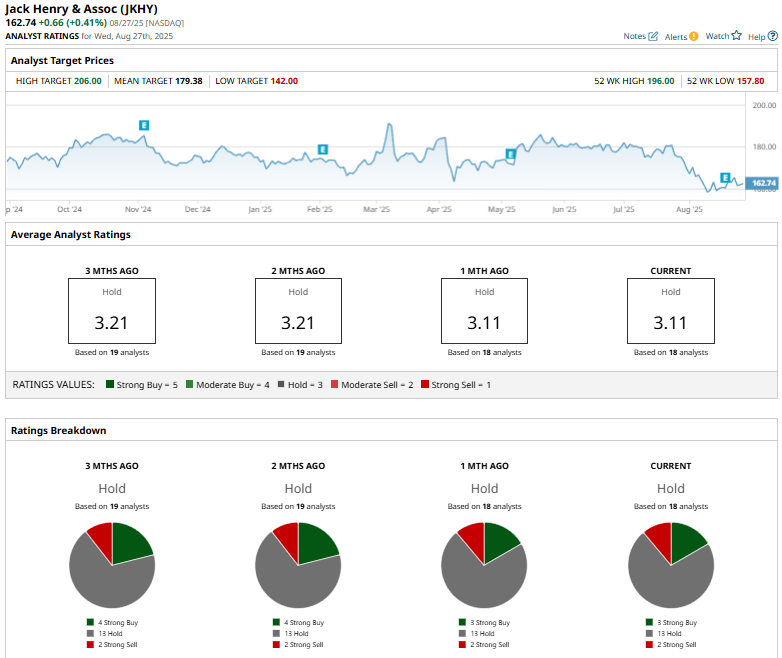

Jack Henry & Associates shares slid 2.3% on Aug. 25 following the announcement of a $0.58 quarterly dividend, payable September 26, to shareholders of record as of September 5, before posting a modest rebound over the next two sessions. For the current fiscal year, ending in June 2026, analysts expect JKHY’s EPS to drop marginally to $6.19 on a diluted basis. On the bright side, the company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters. Among the 18 analysts covering JKHY stock, the consensus is a “Hold.” That’s based on three “Strong Buy” ratings, 13 “Holds,” and two “Strong Sells.”

This configuration is less bearish than two months ago, with four analysts suggesting a “Strong Buy.” On August 18, DA Davidson analyst Peter Heckmann reaffirmed a “Buy” rating on Jack Henry & Associates with an unchanged price target of $212, signaling continued confidence in the company’s performance. The mean price target of $179.38 represents a 10.2% premium to JKHY’s current price levels. The Street-high price target of $206 suggests an upside potential of 26.6%. On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|